Why financial Lifestyle planning is important?

- Each of us strive hard to achieve our general goals and objectives but we tend to forget about planning it right, financially. Of course emotional and cultural goals are very important but if your finances are sorted as per your expectations and goals, then wouldn’t other objectives be easier to manage?

- Every age group has aspirations and wants, though they may different slightly from each other.

Here are some of the questions we would love to have answers to….

- When will I be able to buy my next dream car?

- When can I put together a deposit and afford to pay for my first flat/home?

- When can I take that cruise/big holiday that I always wanted?

And there are decision support questions?

- What is my real lifestyle and can I sustain it in next 5, 10 or 20 years?

- What is my real yield of investment in property today and next 5 – 10 years

- Is my investment giving me return I anticipated?

- Shall I sell or keep my (specific) investment property?

- Is my warranty insurance really worth?

- Which asset shall I keep and which shall I liquidate or swap

- What is my real “Cash in Bank” income from my investment – pre and post liquidation?

- How long can I sustain my current financial lifestyle without changes? Or What Lifestyle can I afford at the age or 40 / 60 / 75 – post retirement etc.

- Is it better for me to buy this (specific) property through Capital repayment or Interest only mortgage? (what are financial differences here?)

- What exact net amount of my assets will be passed on to my beneficiaries in my “WILL”?

- …………. And many more such questions…………

While calculating our financial networth, we tend to miss out looking at “Cash in Bank” numbers, which are key for any exposures in future

It also becomes highly necessary to know what are those major items where the money is being spent

Changes to expenditure patterns (and infact even earnings) can make a substantial difference to our future.

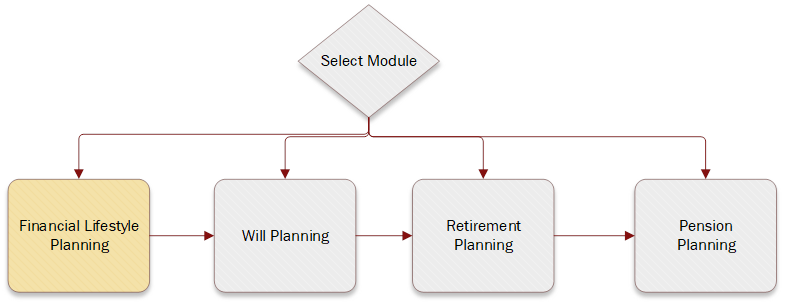

This software will take you through a journey of enlightenment . You will not only get a clear picture of your financial status right now but also be able to plan for future.

Idea is that you are able to take control of your financial future and stability and most importantly utlise that hard earned money optimally.

Ultimately to find net worth... and sustainability. E.g. general cost of living at various stage of life is dynamic - how much should the income and reserve be...? Etc...

it is very difficult to choose an assets where one can invest while considering multiple parameters that affect the decision. Typically a person for go buy a gut feel. Which is always not the best decision. However there is so much information to comprehend, it becomes very difficult 2 go on the specific path. Typical factors affecting such decisions

- cultural factors

- emotional factors

- friends and family factor

- and of course gut feel

- Mortgage type ( capital repayment v/s interest only)

- Liquidate property now , after 5 years.